Table of Content

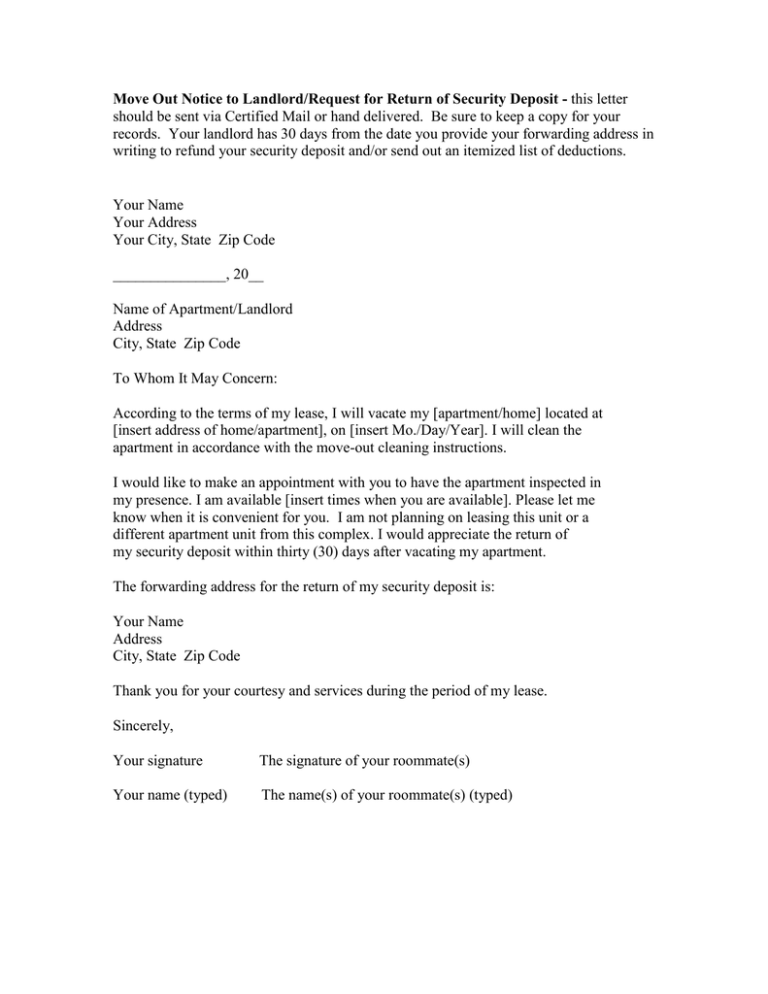

Buying a home in the current market with buyers competing for the small number of homes on the market is intimidating for first time home buyers. If you are renting and you love the home you are already living in, don’t be afraid to ask for what you want. Reach out and we’ll connect you with a real estate agent to help you make it happen. If your landlord is offering to finance it for you, you need to ask a lot of questions. Keep in mind, most seller financing is for a short period of time, like 2-3 years, after which time, you will be required to obtain traditional financing through a bank or credit union.

Your landlord, however, doesn’t realize you’re doing all this research online which helps you level the playing field a bit. You might not realize how killer vacancies are to landlords. If you can get into your landlord’s head a little bit, that will really help you out when you’re negotiating with your landlord. Before you move forward, let’s look at the advantages and disadvantages from your landlord’s point of view. If you’ve done all that, you’re ready move forward. Another disaster story for new homeowners is finding out they have a BAD neighbor.

Specialist Mortgage Help

Another common complaint of new homebuyers is the house was in worse physical condition than they knew when the bought it. They had a lot of big, unexpected expenses after they bought the place. It’s expensive and it’s disruptive to the family, especially if you have kids and they would have to go to new schools. I’ve read that moving is the third most stressful thing in life, behind death in the family and divorce. Just the thought of moving makes some people put off buying homes. First, let’s look at the advantages to you, the tenant, the renter, the potential buyer.

If that’s your case, it’s even more likely your landlord will sell to you and be reasonable about it. Your landlord knows if you pay rent on time and whether you’re a reliable person. They know, going in, whether selling to you is likely to go smoothly or whether to expect it to be a pain in the neck. Don’t be shy about mentioning this to your landlord.

Option #1: Purchase the House Immediately

I'm also wondering what other costs etc they would benefit from selling to a tenant, as i am interested but want to know the facts from both sides before i go back with an offer against their evaluation. A holdover tenant is a renter who remains in a property after the lease expires. Laws for handling holdover tenancy vary from state to state. In some cases, tenants will agree to move out early with a “cash for keys” offer from the new owner, trustee or bank.

This will give you the right of refusal if the landlord decides to sell the property in the future,” adds Haley. While technically not adhering to the legal definition of “as-is”, this is permissible as long as the parties are in agreement. Let’s take a look at how you may encounter the term “as-is” in a real estate transaction. Some who are currently renting a property may wish to own that building as their home. A landlord who is willing to sell may work out an arrangement to sell.

Landlord

And these agreements don’t come with the consumer protections that mainstream mortgages do. So it’s worth exploring a more traditional purchase route before turning to a rent-to-own agreement. It may seem unnecessary because you and your landlord have a good landlord-tenant relationship, but buying a home is a different realm.

Commissions are negotiable but typically range from 4.5 to 6 percent. The listing agent usually gives part of this commission to the buyer's agent. The buyer does not does pay his or her agent directly. If possible, meet with the tenants prior to closing so you can verify the current condition of the home and discuss the lease terms.

One benefit of selling to tenants is that there will be no void period whilst the property is sold. That could be worth a bit of money to your landlord but if your offer is too low it might be more economical to evict you and sell on the open market. Whether you are interested in buying a home to use as a primary residence or an investment property, it’s possible that the property is currently occupied by tenants. If that’s the case, there are a few things you should consider before deciding to go through with the purchase. Read on for a quick introduction to tenant rights, landlord obligations and how to limit risks when buying a house with tenants in place. Before the closing, the buyer’s bank will order an inspection to ensure that the transaction can be properly financed.

You would then take the lowest of all those valuations and make an offer to your landlord based on that. The landlord would take the average of all the valuations and consider your offer. A standard homeowner policy typically won’t do the job. Inform your insurer that the home is being rented so that you’ll be covered in case of tenant injuries, negligence, and other losses.

She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004. Our tenant screening services have been trusted by over 90,000 landlords & property managers since 2007. It’s important to maintain your composure and keep your patience while doing this step of the sale process. Typically, the buyer will set up the closing company, but your attorney can help do that as well. The buyer’s bank is also likely to require an appraisal before the sale goes through, so they will be responsible for bringing in an appraiser as well.

One of the biggest regrets new homebuyers have is buying homes that are too far from work. They buy homes on the outskirts of town because they can get a lot more house for their money but the commute to work is longer… and the commute NEVER gets any shorter. For this house, you already know the drive-times very well and whether they’re okay.

Because the “as-is” specifications refer to a very specific part of the property, this situation is often more palatable to non-investor homebuyers. When the entire property is being listed and sold “as-is”, the seller will not make any repairs, nor offer any credits for potential defects of the home or grounds. Lawyers typically charge per hour, whether or not you buy the house. Ask for an estimate and see if they will agree to a flat fee or cap. Larry Scancarelli, a real estate lawyer in San Francisco, says that for a simple transaction in Sausalito, attorney fees for a buyer might range from $2,000 to $5,000.

Either you or your landlord will need to arrange the RICS valuation. You must get a valuation by a surveyor who is registered with the Royal Institution of Chartered Surveyors . The sale price of your home will be based on this valuation.

Step 5: Close The Sale

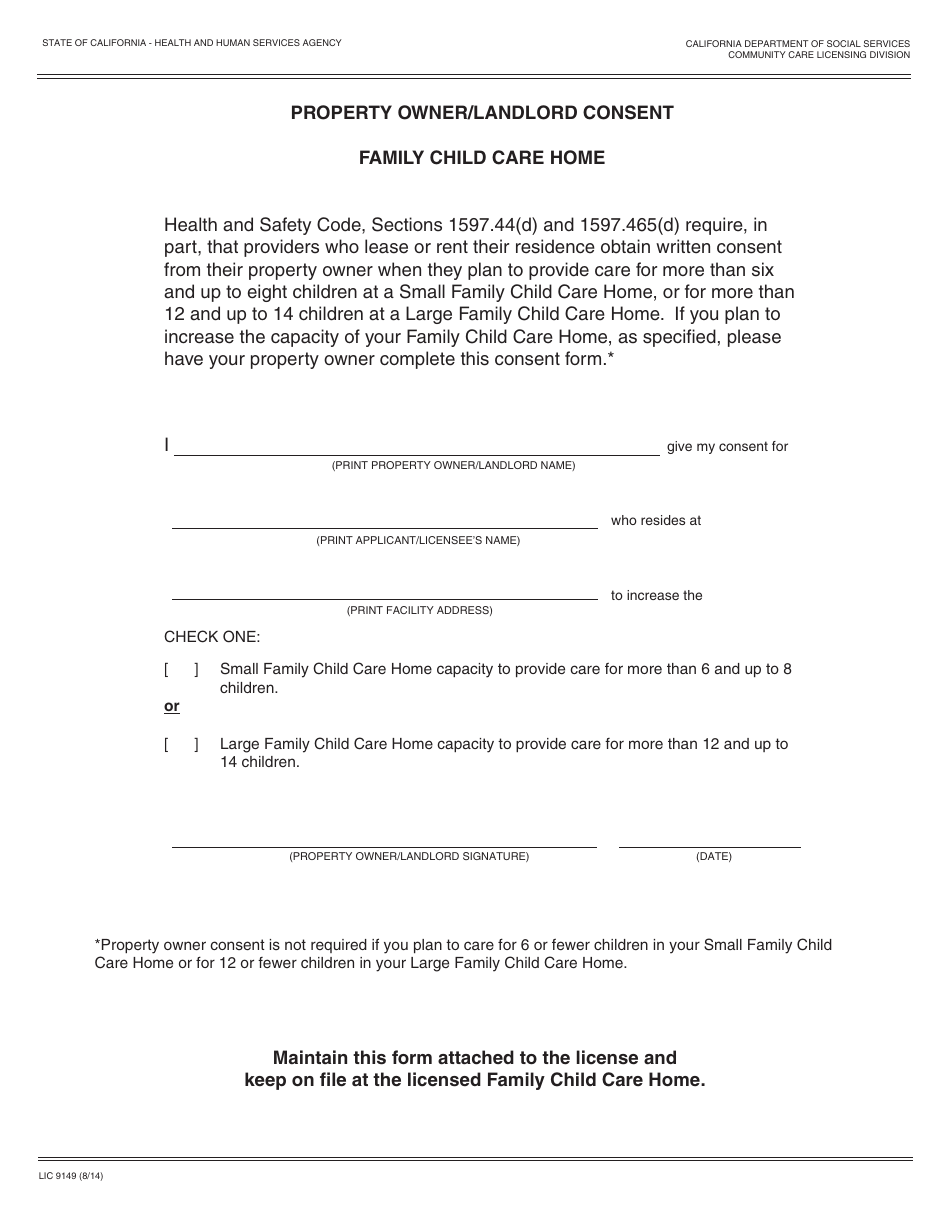

A broker can also calculate your affordability and find out how much you could borrow. This information can help you to move forward with the process of asking to buy your rental home from your landlord, as you’ll have a better idea of how much you can offer. A mortgage broker with access to a range of UK and overseas lenders can compare the most suitable options on your behalf and will only recommend relevant lenders that are more likely to accept you. This can help you avoid possible credit rejections on your file and may also save you time and money.

In many cases, you will be able to find an attorney or a real estate agent that will handle the process for a flat fee. Depending on your budget for the transaction, you can make your choice about what type of team to assemble. Additionally, if you are unable to qualify for a mortgage after the designated time period, you will also forfeit your down payment money to the landlord. And some landlords who are near breakeven would lose money if they had to pay a 5, 6 or whatever percent in commissions to real estate agents.

No comments:

Post a Comment